Beyond the Easter Peak: Data-driven decisions with Scintilla

Harness the right omnichannel data to analyze historical seasonal trends, optimize performance, and grow your brand at Walmart Canada

With the dynamic nature of Easter's timing each year (April 9 in 2023, March 31 in 2024, and April 20 in 2025), year-over-year comparisons of key metrics can be challenging. This makes it difficult to identify true underlying sales trends. That’s where Scintilla steps up. By offering seamless access to Walmart's first-party data, Scintilla delivers an intuitive platform that allows you to delve into your brand and product performance with unparalleled granularity – from annual overviews to hourly breakdowns.

Our team utilized Scintilla Shopper Behavior to analyze the wealth of data from the past three Easter periods at Walmart Canada, uncovering crucial trends that can inform your strategic decisions. Let's explore some key overarching insights:

Understanding Easter Peaks: A foundation for strategic planning

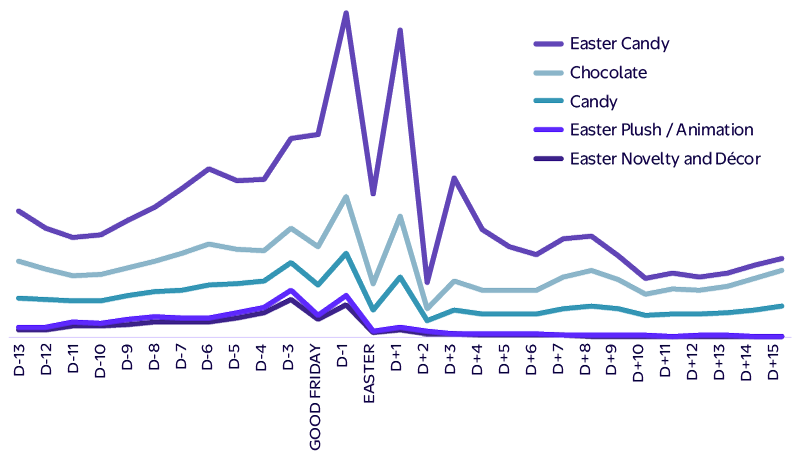

The data clearly indicates consistent surges in customer activity across both Walmart Canada's General Merchandise (GM) and Grocery categories in the lead-up to Easter. This heightened activity typically begins approximately seven days before the holiday and remains active for about a week afterward, due to the off-season clearance event. Notably, in 2024, customer traffic for Easter Candy and Seasonal categories peaked two days before Easter, reaching nearly double the average daily count.

These trends show how shoppers planned ahead, with many making last-minute purchases just before the holiday and continuing to browse seasonal aisles well after the celebrations ended.

Source: Walmart First-Party Data provided by Scintilla, May. 2025. Reflecting Apr. 2022 - Apr. 2024

Unlocking Category Synergies: The power of basket analysis

Leveraging Scintilla Shopper Behavior’s Basket Report, we uncovered key insights into how customers in 2024 approached Easter spending—and the evolving ways they looked to stretch their budgets.

- Price sensitivity increased across all departments, especially in Seasonal Kitchen and Bakery categories, with Breakfast and Sweets not far behind.

- Shoppers gravitated toward fewer items per basket but offset that shift by purchasing larger pack sizes more frequently—ultimately balancing overall spend.

These patterns highlight the growing importance of competitive pricing and value-focused assortments to meet customers where they are.

Shopping trends

Diving deeper into Scintilla’s Shopper Behavior Basket report uncovered emerging patterns across key GM categories at Walmart Canada—especially around Easter traditions like filling plastic eggs with candy and other surprises.

- Top-performing categories included Plush/Animation, Easter Novelty and Decor, Kitchenware, and Children’s Apparel, all of which saw increased placement in customer baskets.

- Easter Candy, Chocolate, and broader Candy categories contributed meaningfully to Easter sales. However, the biggest growth opportunity came from shifting customer behavior:

- Shoppers increasingly chose larger pack sizes and premium brands, resulting in higher average prices within the category.

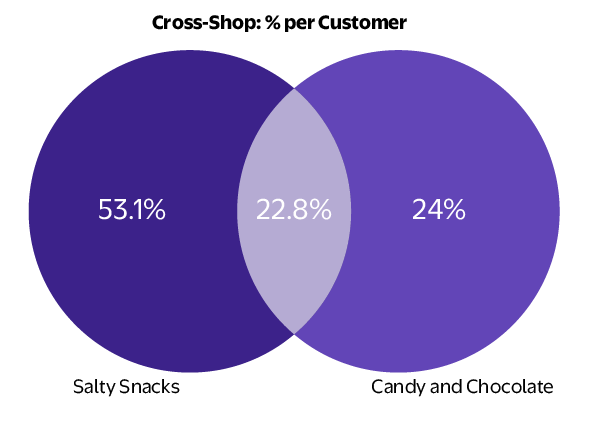

- Notably, 23% of customers who bought Candy and Chocolate also purchased Salty Snacks—and spent twice as much as those who bought sweets alone.

This represents a powerful cross-shop opportunity between Candy & Chocolate and Salty Snacks.

Source: Walmart First-Party Data provided by Scintilla, May. 2025. Reflecting Apr. 2022 - Apr. 2024

Shopping lists

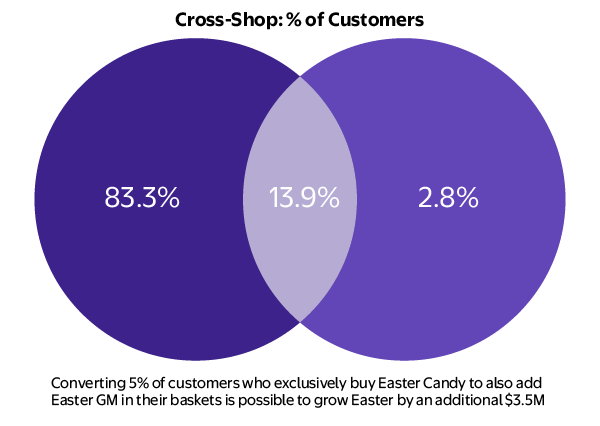

The Shopper Behavior Basket report also revealed that in 2024 only 14% of customers at Walmart Canada purchased both Easter General Merchandise (GM) and Easter Candy/Chocolate during the three-week period leading up to the holiday (3/16/2024 to 4/5/2024). But those who did spent nearly 3x more than customers who only bought Candy and Chocolate.

- We also noticed that not just traditional Easter items like Candy & Chocolate were benefiting. Unexpected categories such as Vegetables, Refrigerated Baked Goods, and Cream also benefited.

Source: Walmart First-Party Data provided by Scintilla, May. 2025. Reflecting Apr. 2022 - Apr. 2024

Make the most of Easter with Scintilla's integrated insight ecosystem

As a Walmart merchant or supplier, you can gain access to rich first-party data and deep behavioral insights to stay ahead of the curve and adapt your strategy to meet shifting shopper preferences. With Scintilla, you'll be better equipped to deliver unmatched value across every seasonal moment.

Sign up to discover how Scintilla can elevate your strategy and drive success in the competitive retail landscape.

References:

Source: Walmart First-Party Data provided by Scintilla, May. 2025. Reflecting Apr. 2022 - Apr. 2024